Why City AI Is a Growth Engine for Infrastructure Markets

- Jan 11

- 3 min read

Updated: Jan 25

There is a recurring assumption among investors and technologists that municipal AI initiatives could limit private-sector upside. The logic goes like this: if cities build digital twins and AI platforms, they may internalize capabilities that companies would otherwise sell. This belief surfaces less in public critique than in behavior. Particularly in capital allocation, where city-facing AI deployments are often discounted as slow-moving, low-margin, or primarily reputational rather than revenue-generating.

Miami proves the opposite. And it is not alone.

Across the country, and increasingly globally, cities are beginning to play a similar role: not as AI builders, but as hosts and anchor customers for compute-intensive systems that must operate in real-world conditions.

Cities Live at the Application Layer

Miami’s Brickell AI Digital Twin sits alongside a growing cohort of city-led AI deployments that share a common structure, even if their use cases differ.

New York City uses AI-driven modeling for energy benchmarking, building performance, and climate risk analysis across its dense real estate portfolio.

Los Angeles deploys AI for traffic optimization, wildfire risk modeling, and port logistics; all systems that require continuous inference and simulation.

Chicago has invested in urban sensing and predictive analytics for infrastructure maintenance and public health.

Singapore operates one of the most advanced national-scale digital twin initiatives, Virtual Singapore, designed to simulate mobility, energy use, and climate impacts.

In every case, the pattern is the same: cities define the problem space and provide access to real-world constraints, while private companies supply the models, compute, and physical infrastructure.

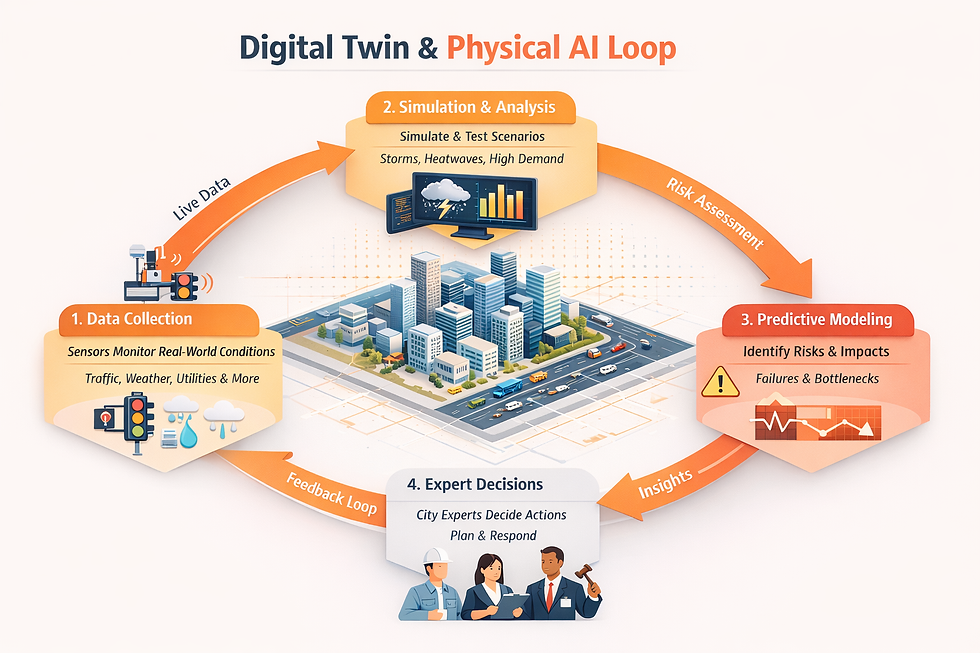

The AI stack is not abstract; it is hierarchical.

At the top sit use cases: traffic optimization, climate resilience, zoning simulation. Cities live here.

Below that sit models and platforms: computer vision, simulation engines, predictive analytics.

Below that is compute demand: training, inference, real-time simulation.

At the bottom is physical infrastructure: data centers, power, cooling, interconnect.

Cities do not descend this stack. They activate it.

Every new city use case increases compute demand. Every persistent digital twin creates permanent workloads. These are not bursty experiments. They are 24/7 systems.

Why City AI Grows the Market, Not Shrinks It

Before city adoption, AI demand was largely discretionary around enterprise optimization, consumer features, and experimental tools.

City adoption introduces:

Non-discretionary workloads

Public safety use cases

Climate resilience mandates

Politically durable budgets

This is the kind of demand infrastructure markets are built on.

Companies that own or operate data centers, power infrastructure, and high-density compute benefit when AI escapes the lab and embeds itself into civic systems. These workloads are sticky, long-lived, and difficult to migrate.

Cities Cannot Vertically Integrate

Even if a city wanted to internalize AI infrastructure, it would fail. Cities cannot:

Manufacture GPUs

Operate hyperscale data centers

Solve cooling at scale

Secure long-term power contracts

They are structurally incapable and it is not their core business model.

This is not a weakness. It is a guarantee.

Infrastructure providers are protected by physics, capital intensity, and institutional mismatch. Cities will always consume, not compete.

The Only Real Constraint: Power

If there is a risk to this model, it is not saturation; it is bottlenecks. Power availability, grid constraints, and permitting delays can slow deployment.

That is why energy-adjacent infrastructure like nuclear, small modular reactors, and advanced cooling emerges as a downstream beneficiary of city AI.

When AI becomes civic infrastructure, energy becomes strategic.

What This Means for Cities and the AI Market

This is why city–AI partnerships deserve sustained, component-level analysis rather than one-off hype cycles. Governance incentives, capital flows, infrastructure economics, energy systems, and regulatory leverage each operate on different timelines; and each warrants its own examination.

Miami’s AI Digital Twin does not compress margins or crowd out private innovation. It does the opposite: it expands the surface area of demand by turning urban systems into continuous, real-world AI workloads.

Cities are becoming one of the most consequential customer classes in AI not because they invent technology, but because they make its deployment unavoidable and durable.

Miami recognized this early. A growing number of cities are now stepping into the same role: host, amplifier, and long-term customer.

That is why the future of AI will not be built only in labs or data centers. It will be negotiated, tested, and proven in cities willing to open their doors.

Comments